8 Cash App Scams: How to Spot the Signs and Send Money Safely – Cash App makes it easy to send money online. But as with many popular peer-to-peer payment apps, it can also be a fertile ground for scammers. Learn about the Cash App scams criminals could use to trick you. Then, download a private browser to help secure your online financial transactions and protect your personal data.

What is Cash App?

Cash App is a peer-to-peer (P2P) mobile payment app for people in the US and UK that lets you send money to other Cash App accounts. You can also invest in stocks through Cash App, trade Bitcoin, or pay for goods and services at participating retailers.

Cash App is similar to Venmo, Zelle, and other P2P payment apps. Such apps are sometimes called money apps or cash transfer apps. Because it can be a hassle to pay someone back, apps like Cash App were created to let people send money quickly and conveniently. Over time, Cash App’s popularity has grown and expanded to other services.

How does Cash App work?

To send money through Cash App, enter the amount you want to transfer, find and select the user, then tap Pay. The money appears in the receiver’s Cash App balance, which they can then transfer to their bank account or leave in Cash App. You can also request money from someone using the same process, tapping Receive instead of pay.

Download Cash App through Google Play or the Apple Store, just like any other cash transfer app. Then, make a unique tag (called a $Cashtag), and link your Cash App account to your bank account. Using your $Cashtag, you can request or pay money without sharing bank account details.

Sending and receiving money is free, just like standard deposits to your bank account, and takes 1-3 business days to arrive. If you think Cash App is taking money without permission for service charges, keep in mind that they charge 0.5% to 1.75% for instant deposits. Small businesses are charged 2.75% on payments received.

How safe is Cash App?

Cash App is safe for transactions with people you trust and can verify personally. It is not meant as an alternative to a debit card. Unlike a debit or credit card, Cash App does not have robust protections for fraudulent transactions.

It’s safe to receive money on Cash App from strangers (when you’re expecting it) because no sensitive details are revealed. The same applies when sending money.

Cash App is generally safe for small personal transactions, as it offers the following safety features:

- Encryption: Any information you send through Cash App is encrypted, whether it’s over private or public Wi-Fi, or a data service like 4G.

- PIN and sign-in protections: Whenever you sign in to Cash App, you are sent a one-time passcode. You can also enable a PIN input for every transaction.

- Biometric settings: Cash App has a Security Lock feature in its Privacy & Security settings, where you can toggle biometric data, like Touch ID or facial recognition, to send money.

- Notifications: If Cash App notices unusual activity, it will alert you through push notifications, text, or email.

- Fraud monitoring: Cash App occasionally cancels transactions that look out of the ordinary, but its protection is limited.

You can also get a Cash Card that’s linked to your Cash App account balance. Instead of using your phone, you can use the Cash Card anywhere Visa is accepted. If your Cash Card is lost or stolen, you can disable it remotely.

Can someone steal your Cash App account? Not unless they have access to your phone. If you notice phone hacking signs, stop using Cash App and any other payment app immediately. Though Cash App itself is safe, the quick access to money has opened the platform to a variety of different types of scams.

Can someone be scammed through Cash App?

Yes, there are fake Cash App scams that target users. On Cash App, anyone can send a payment to anyone else, or request payment from anyone else. That open contact allows fraudsters to pull various scams. If a random person sends you money on Cash App or requests money, it’s likely a scam.

Popular Cash App scams

Most Cash App scams are a form of social engineering, where scammers try to trick their targets into giving up sensitive details or performing unsafe actions.

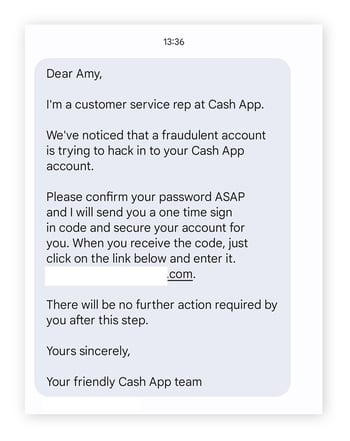

1. Impersonating customer support

Similar to tech support scams, Cash App scammers could contact you via phone, text message, DM, or email, pretending to work for Cash App. They’ll try to get your Cash App passcode and one-time password to gain access to your account.

Customer support scammers can be convincing, because they often spoof the Cash App number or name. Communicate with Cash App only through the app itself, by calling the number from their official website, or use the official Cash App support site.

2. Selling expensive items

Cash App offers business accounts for small businesses to sell goods and services. Scammers may open a fake Cash App account and get you to pay for a great “deal” on a desirable item, such as concert tickets or rare collectibles. Then, after you pay, they’ll stop responding.

To stay safe from Cash App business account scams, make purchases only from established retailers or those you know personally.

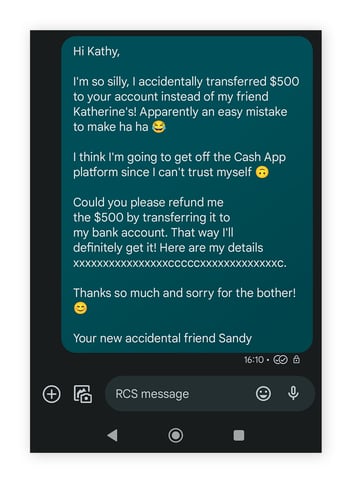

3. Accidental transfers

A common trick Cash App scammers use is sending “accidental” transfers from stolen credit cards or hacked accounts to their victims. The victim is then asked to send the money back to the scammer’s fake Cash App account. The “accidental” transfer is then also soon reversed by the other scammed victim’s bank, and the scammer disappears with your money.

If someone sends you money on Cash App randomly, don’t respond to any messages about returning it. Report the scam directly to Cash App.

4. Cryptocurrency schemes

Cryptocurrency is a common target of Cash App scams since it’s largely anonymous and nearly impossible to recover. Scammers message you claiming huge returns if you invest a small amount of cryptocurrency, but you’ll never see any returns. Crypto scammers also use hacked social media accounts to launch Cash App scams to the hacked account’s friend list, hoping to cash in before anyone notices.

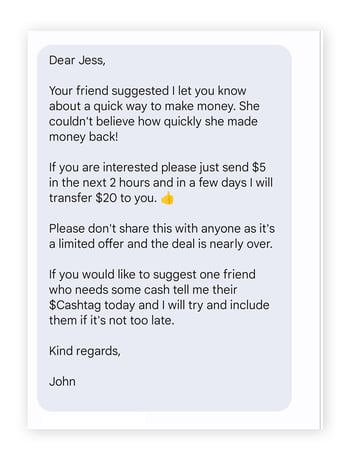

5. Cash flipping

Cash flipping scams, also known as money circle scams, are a cybercrime version of real-world pyramid schemes. The scheme may promise to double or quadruple your money by investing it in the stock market through a friend or professional contact. But just like pyramid schemes, they’re designed to scam people out of their money.

Cash App users can be targeted directly on Cash App, on a social media platform, or by SMS. Scammers also post details of these money-making schemes on social media and wait for interested people to take the bait. They then ask them to send money through Cash App.

6. Cash App Friday Scams

Cash App once did a #CashAppFriday promotion that went viral on Twitter and Instagram, where anyone who followed or commented with their $Cashtag was entered in a cash giveaway. Scammers have exploited the popularity to run fake Cash App Friday promotions. Everyone who enters the “contest” is messaged saying they’ve won — they just have to pay a fee or enter banking details to claim their “prize.”

Cash App has since shied away from Cash App Fridays, but the company often runs similar promotions with gift cards, Bitcoin, and other prizes. If you want to know if a Cash App giveaway is real, confirm it’s a verified Cash App account first, and never pay someone a fee to receive money.

7. Phishing, vishing and smishing

Phishing is how scammers get you to give up your details or click dangerous links in a fake email, while vishing works through voice calls and smishing through SMS. There are also platform-specific scams such as Apple ID phishing scams.

These Cash App scams involve scammers impersonating authority figures, businesses, colleagues, and the like. The aim is to trick you into handing over sensitive info, such as your login details, or opening links that trick you into doing the same. Scammers are often after money in the end, but they may also try to scam people you know by pretending to be you. You can help prevent phishing attacks by knowing how to identify fake texts and keeping your personal information to yourself.

Cash App scammers can impersonate a trusted organization via the phone, email, or text.

8. Romance scams

Romance scams come in many forms, but the premise is always the same: Hook lonely or desperate people into sending money in exchange for a love that will never be. Romance scammers typically scout a target before making their moves.

Catfishers use a fake online persona and pretend to be a potential mate for their victim. They dangle the prospect of meeting in person, but a problem always comes up that supposedly only a Cash App transfer or payment can fix, such as money to buy a plane ticket. Romance scammers will drain their dupes as much as possible before cutting them loose.

9. Screenshot scam

Cash App screenshot scams are when Cash App scammers send fake screenshots “proving” that a payment is pending, an investment you made has turned into big money, that you’ve won a prize, or some other alleged win. They will then ask you to send them money back for some reason, such as claiming that the total they “sent” you was incorrect.

In a version of gift card scams, they might ask you to refund them through gift cards instead of Cash App. When requesting money, Cash App scammers sometimes ask you for a screenshot of your payment as well. This screenshot could then be used as “proof of payment” for other people the scammer is scamming.

10. Government scams

Another form of Cash App fraud is pretending to be the government to send you a tax refund, relief, or another type of government stipend. The scammer contacts you and needs your social security number or Cash App details to send you the money. Scammers might also say you need to pay a tax through Cash App before they can release the funds.

No government agency will ever contact you through Cash App, or ask you to send money through a payment app. Communicate with government agencies only through official channels.

How to avoid Cash App scams

The best ways to avoid Cash App scams are by staying alert and knowing what to look for. But even with your best intentions, a hacker may find a new way to slip malware on your phone through a Cash App scam — always make sure you have a quality free antivirus on all your devices to keep them safe.

Send payments only to people you know and trust

Cash App is safe for splitting bills and paying for one-time services or other small transactions, but it’s risky for larger payments. Any transactions with those you don’t know personally leave you open to manipulation. When dealing with businesses, make sure to double-check for typos, alternate spellings, or letter-swapping tricks (such as using an upper-case “i” instead of a lower-case “L”).

Don’t share your personal details online

Be careful what you share online, especially when it’s not on a private account. A scammer doesn’t need a lot to send you a convincing fake email, SMS, or DM, then move the scam to Cash App. Any online personal details can also be gathered to scam you in the future, or they can be sold to data brokers.

And never share your Cash App PIN or any other account details online, even if you receive an official-looking email or message. Cash App will never ask you for your PIN or sign-in code.

Don’t give out personal information to strangers. Use privacy settings on all your accounts to help protect you from Cash App scammers.

Review your bank account statement regularly

Check your bank account and Cash App transactions regularly for any suspicious activity. Review your credit report occasionally for discrepancies, too.

If you think you’re under threat of identity theft, you can set up a fraud alert on your credit report to put the relevant agencies on notice. You should also use a free tool like Avast Hack Check, which is included with Avast Secure Browser, to see if any of your passwords have been exposed in a data breach. If so, quickly change your passwords to help secure compromised accounts.

Don’t click suspicious links

Cash App scams often involve links to unsecured websites made to look legit. Or they can lead to malware that steals data and spies on you. Clicking suspicious links can not only drain your wallet, but it can damage your device or send you to the dark corners of the internet. Our website safety check guide can teach you the warning signs to watch out for.

Use strong, unique passwords

If you use the same password for multiple accounts, and scammers get their hands on it, they could use it against you in a Cash App scam, a Venmo scam, or another type of financial fraud.

Always create strong, unique passwords for all your accounts. Weak passwords consist of anything that can be found online about you, including your distant past. Use one of the best password managers to help keep all your passwords safe.

Use two-factor authentication

Two-factor authentication (2FA) requires two forms of verification before letting you into an account. If it’s not set up on your Cash App account, make sure you use it. Cash App will help keep you secure by sending you a one-time password every time you sign in.

Biometric data and using facial recognition technology like Apple’s Face ID can also help secure your phone and accounts. There are also dedicated verification apps you can use like Google Authenticator.

Use two-factor authentication (2FA) to keep your online accounts more secure.

Turn on alert settings

You can turn on notifications for all Cash App transactions to track account activity wherever you are. If someone is trying to access your funds, you’ll know right away.

I think I’ve been scammed, what do I do?

Once you realize you’ve been scammed, you need to make sure your Cash App is safe. If a random person has sent you money on Cash App, don’t engage.

Report and block the account

To report a scam to Cash App, call their support line at 1-800-969-1940 or start a chat via the app.

To block a Cash App account:

- Tap the Activity tab on the home screen.

- Tap the scammer’s name.

- Tap Block at the bottom of their profile.

Change your Cash App account details

If you think a scammer has any of your details, immediately change your login information and PIN. And add 2FA settings if you haven’t done so. Also consider transferring your balance to your bank account.

Contact your bank

Though it’s difficult, if you can prove Cash App fraud took place, it’s possible your bank can help recover the funds. However, banks typically don’t cover Cash App or other money apps in their policies, so they may not be able to help.

Contact the Financial Trade Commission

You can report a mobile payment app scam to the FTC if you think you’ve been had. And learn how to report any internet scam you come across to help stop others from being scammed.

Will Cash App refund money if I’m scammed?

There’s no guarantee you’ll be refunded if scammed through Cash App, though banks may reverse charges in specific cases. Credit card users have chargeback rights for fraudulent purchases, but there are no such guarantees for Cash App fraud.

It’s possible that Cash App could cancel a transaction if you notify them immediately. But once you send payment, and especially if it gets to the scammer’s account, it’s likely gone forever.

Unless you’re dealing with friends and family, it’s best to send money through secure channels with advanced security features. In any case, you should use one of the best secure browsers for extra privacy whether you’re using Cash App, shopping online, or sending any other secure information online